Taxation: How Much Do Audits Generate?

Many individuals and businesses were in the Collectivité’s line of sight because they were not paying their due taxes. They took advantage of the permissiveness of Government services responsible for the recovery, which generated several millions of Euros in unpaid dues. Nearly € 25 million for taxes on income, for example. Indeed, audits have been implemented and conducted by state officials in recent months. And they were successful since € 3.4 million of unpaid Income taxes were collected in 2015.

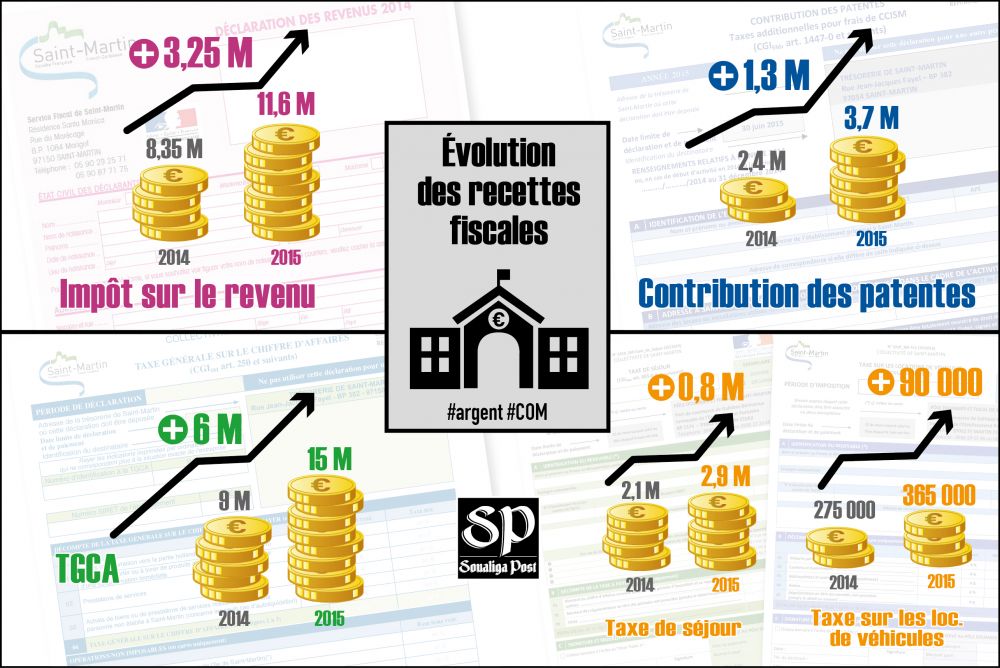

Surely all of these audits helped increase the Collectivité’s tax revenues in 2015. Overall, they were up 28% in one year, from € 74 million to € 94.5 million. If we consider the revenues from five taxes whose recovery was deemed low (income tax, business tax, TGCA, tax on car rentals and tourist tax), revenues increased by € 11.6 million in 2015 to reach € 33.56 million; a performance not solely based on a tax compliance momentum from the population.

TGCA RECORD

In absolute terms, the revenues that experienced the largest increase is the TGCA. In 2015, overall tax revenue from businesses generated over € 15 million, which is € 6 million more than in 2014. A record! This is what it had generated cumulatively in 2012 and 2013. This is 2.4 times more than it had generated in 2011, the first full year this tax was due. Note however that as of January 1st, 2015, a 2 points increase in its rate was extended to all products, thus explaining some of the revenue growth.

TOURIST TAX: + 40% IN ONE YEAR

Another very small tax, the tourist tax has a rate of 4%. In 2008, it had generated € 1.44 million. In 2015, it generated more than twice this amount with a record of € 2.9 million. This is partly due to the implementation of audits by customs officers, with whom the Collectivité has signed an agreement.

The trend is clear: between 2009 and 2012, the product of the tourist tax has never exceeded € 1.3 million. It had even decreased between 2008 and 2011, from € 1.4 million to € 1.2 million. While tourist numbers had not dropped as to justify this reduction. Then, in 2013, revenues increased to reach around € 1.7 million, but the potential for improvement was still great. Evidence in 2014 with the collection of more than € 2 million and € 2.9 million collected last year.