Income tax should be filed by May 31 on French side

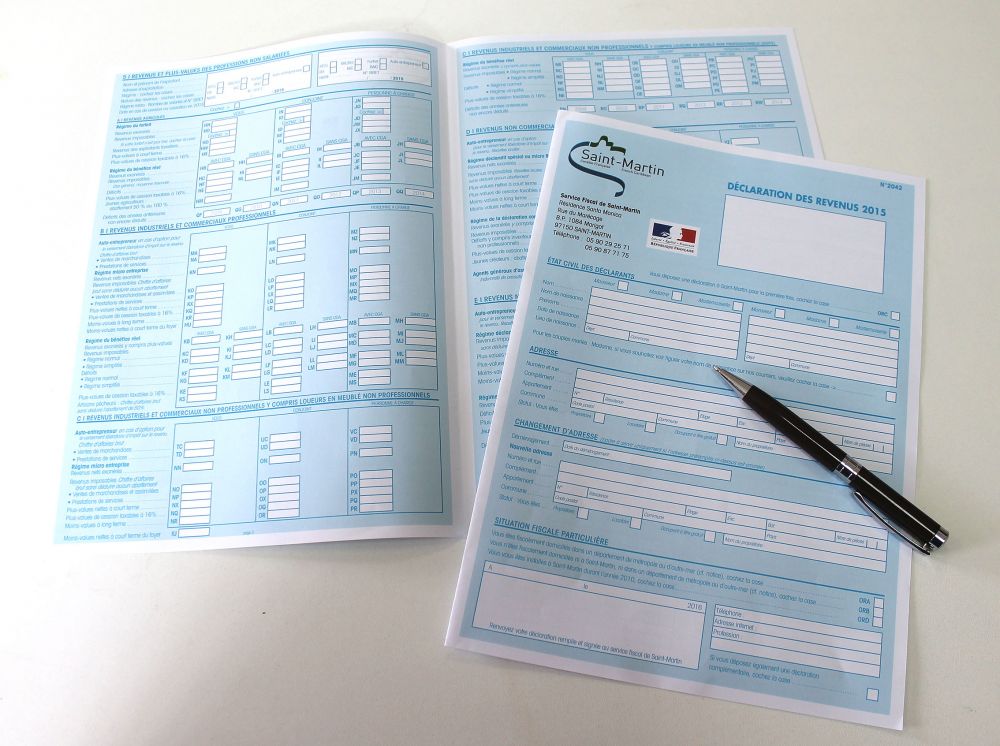

This year, the form is blue, but the content and method to complete it remain identical to those of previous years. On page 3, one must indicate the total of wages and pensions, income from one’s movable capital, land revenue, etc. received in 2015 after having provided all information relating to one’s taxable household.

If you live in Saint-Martin, you should also check a box at the bottom of the first page of the form. This will identify you as a tax resident. This means that you will pay your taxes - if you are taxable - in Saint-Martin, you no longer file taxes in Guadeloupe. However, if you are not identified as a tax resident, you must file your return (Form 2042 with the header of the Finance Department of Guadeloupe) in Basse-Terre.

Foreigners living on the French side but working on the Dutch side also have to declare their income and file a special form, "Income Earned Abroad."

All tax situations are explained on the Collectivité’s website, several instructions, and related forms will be downloadable once La Poste starts distributing the printed forms, which is expected sometime in the next week.

You have until midnight Tuesday, May 31st, 2016 to complete and file the form with the tax center located Residence Santa Monica in Concordia. Taxpayers who miss this deadline will see their return increased by 10%.

People who need help to complete their statement will be able to meet the tax authorities starting May 2nd on Mondays, Tuesdays, and Thursdays from 8:00 to 12:00 and from 2:00 p.m. to 4:00 p.m., Wednesday, and Friday from 8 am to 12 noon. Office hours will be provided in Sandy Ground, Grand Case, and Quartier d’Orléans, places, and times will be announced later.